vermont income tax brackets

Vermont also has a 600 percent to 85 percent corporate income tax rate. 2017-2018 Income Tax Withholding Instructions Tables and Charts.

Vermont Property Tax Rates By Town Lipkinaudette Com

Income tax brackets are required state taxes in.

. Discover Helpful Information And Resources On Taxes From AARP. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Ad Browse discover thousands of unique brands.

Tax rate of 66 on taxable income between 40351. Ad Compare Your 2022 Tax Bracket vs. 2016 VT Rate Schedules and Tax Tables.

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. This form is for income earned in tax year 2021 with tax returns due in April 2022. The Vermont State Tax Tables below are a snapshot of the tax rates and thresholds in Vermont they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates.

The Vermont Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. Your 2021 Tax Bracket To See Whats Been Adjusted. Vermont Tax Brackets for Tax Year 2021 2021 Tax Brackets and Income ranges will be listed here as they become available.

The Federal or IRS Taxes Are Listed. Ad File Your State And Federal Taxes With TurboTax. In addition to the Vermont corporate.

Tax Rates Cigarette Tobacco Tax Rates Education Property Tax Rates Individual Tax Tables and Rate Schedules Local Option Tax Zip Codes. The chart below breaks down the Vermont tax brackets using this model. See If You Qualify To File State And Federal For Free With TurboTax Free Edition.

Tax rate of 335 on the first 40350 of taxable income. See Why Were Americas 1 Tax Preparer. In addition check out your federal tax.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. Tax Rate Filing Status Income Range Taxes Due 335 Single 0. For single taxpayers living and working in the state of Vermont.

Meanwhile total state and local sales taxes. W-4 Pro Select Tax Year 2022. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 3960000 youll.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. Read customer reviews best sellers.

Here is a list of current state tax rates. The Vermont Single filing status tax brackets are shown in the table below. Vermont based on relative income and earningsVermont state income taxes are listed below.

Vermont Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 6000.

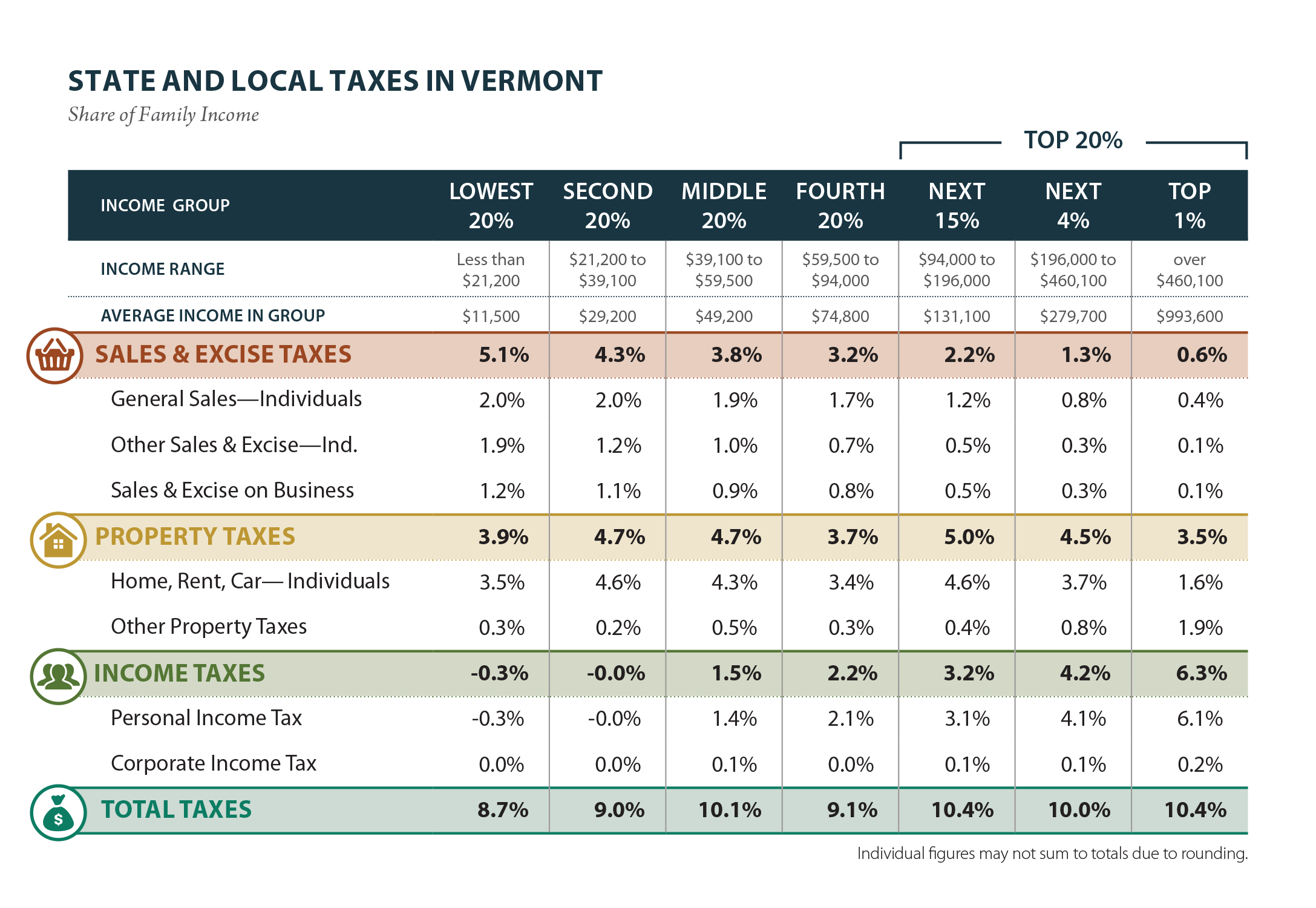

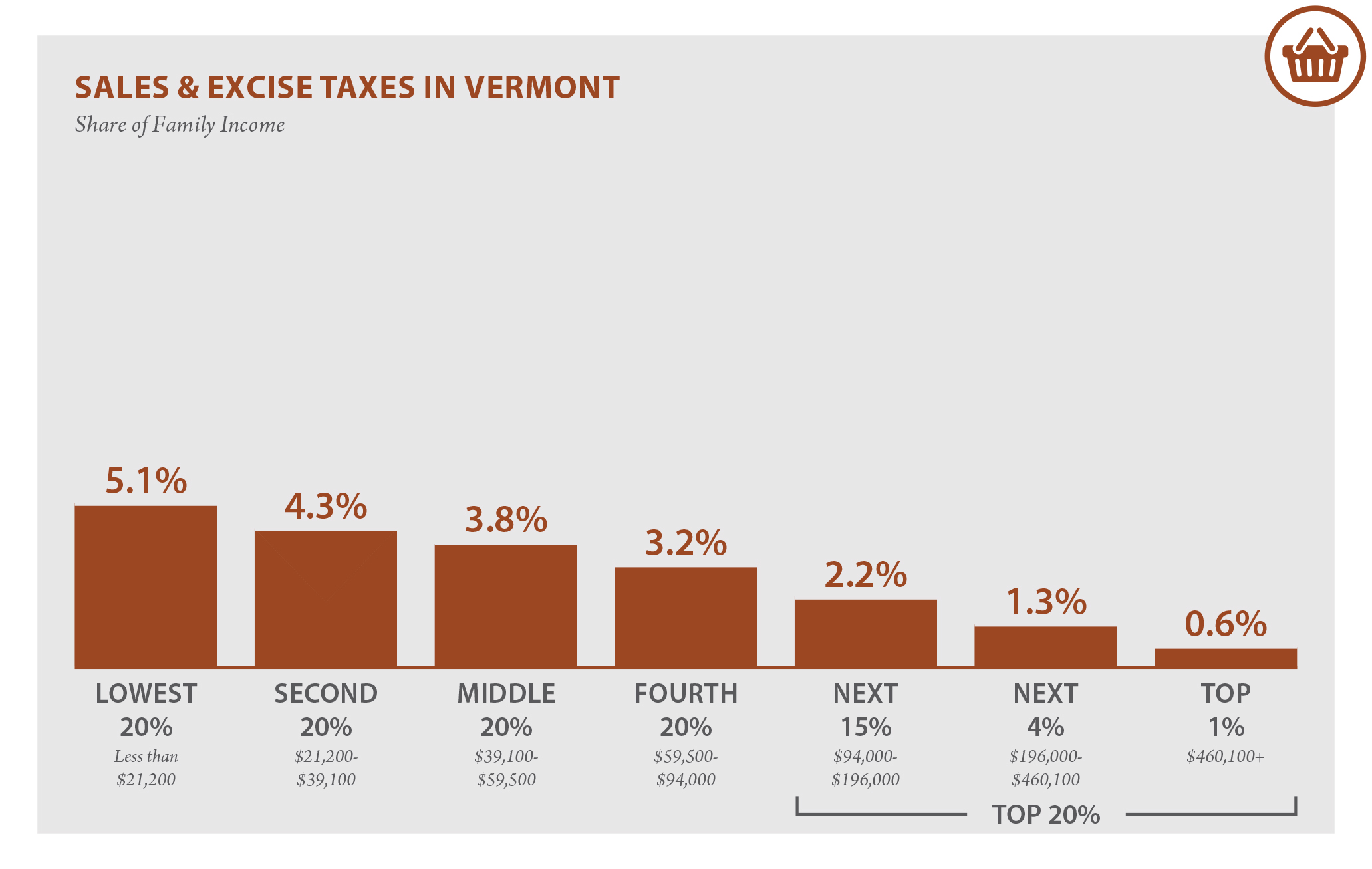

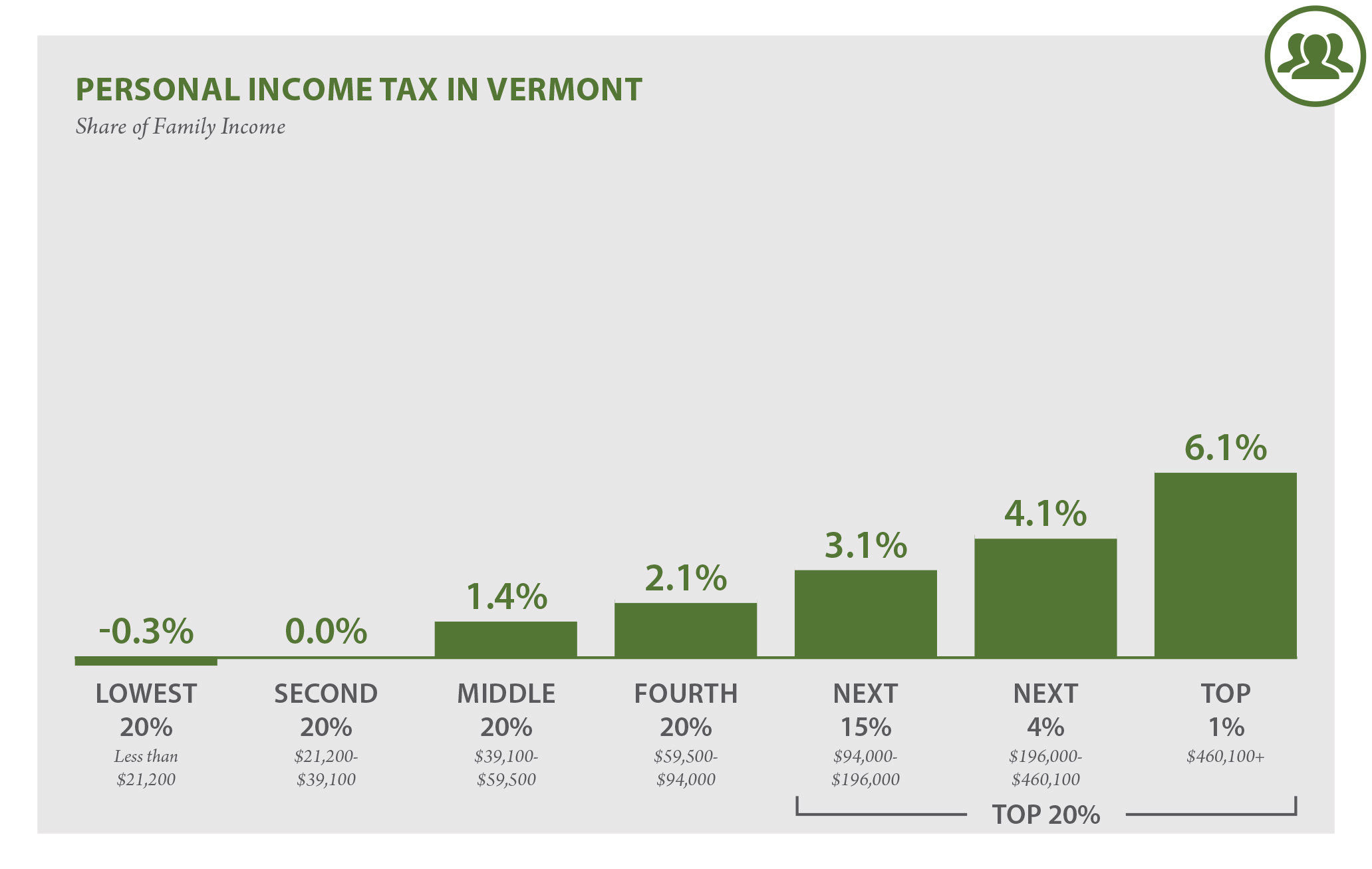

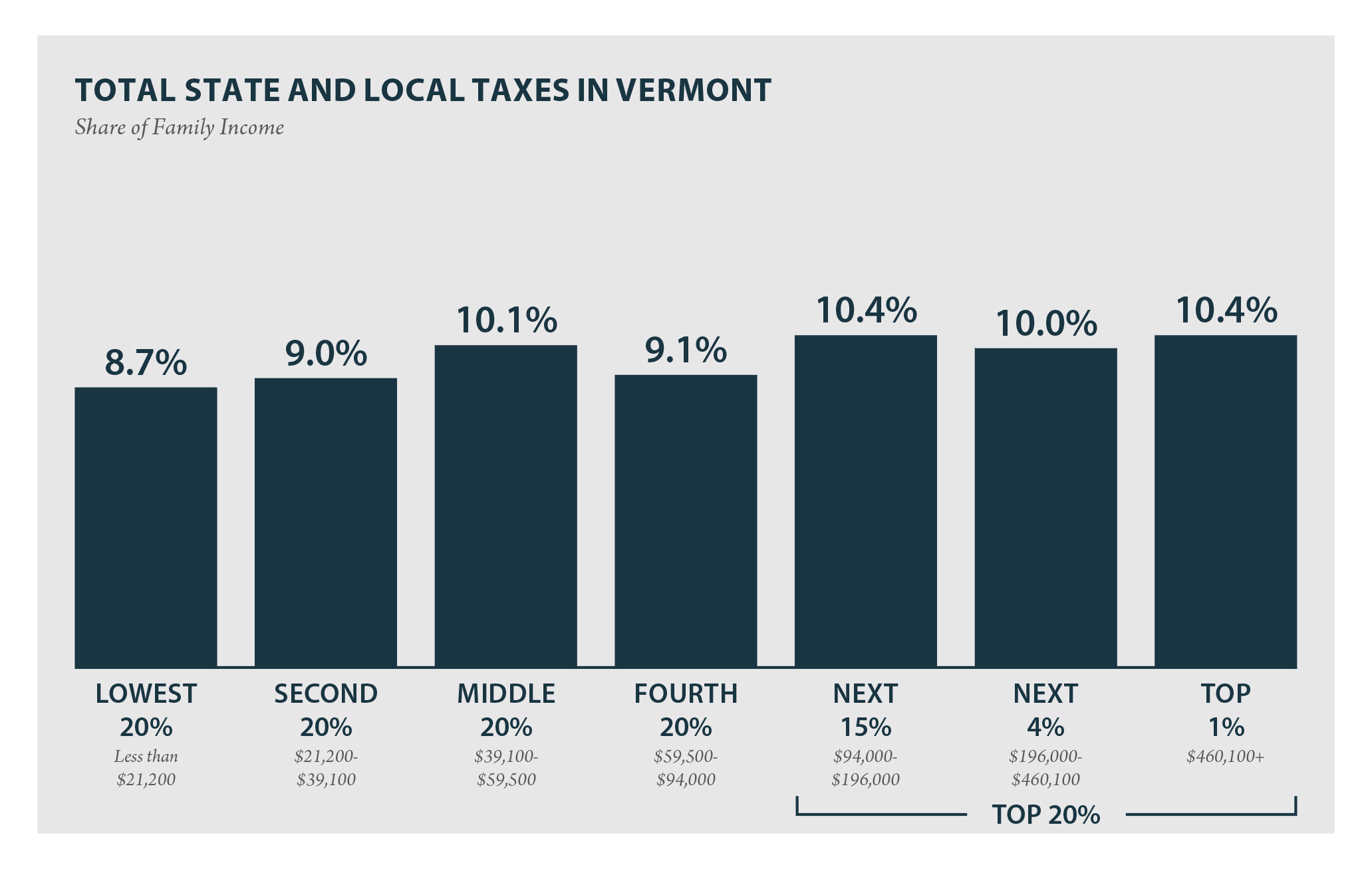

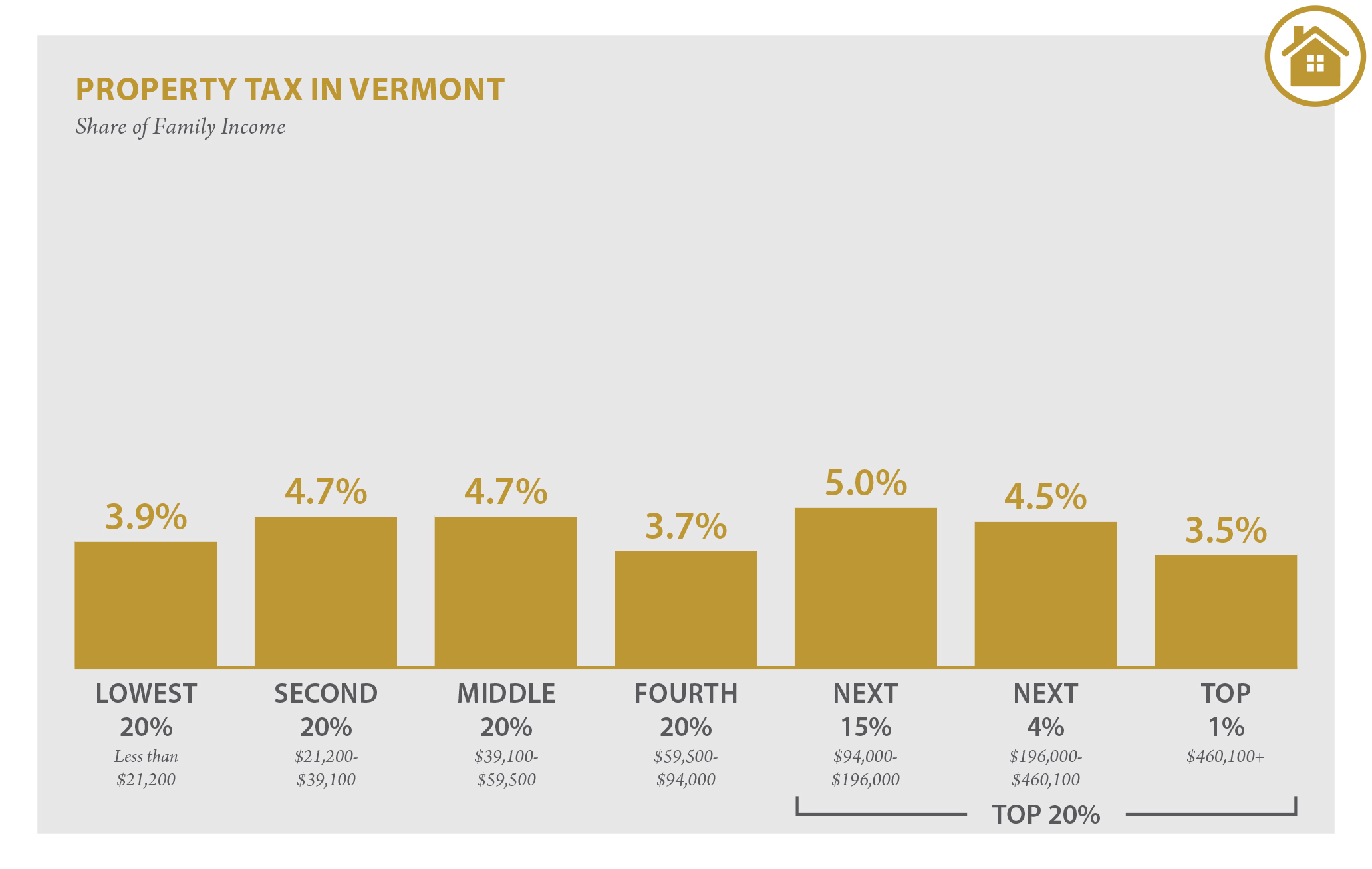

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

The Most And Least Tax Friendly Us States

Vermont Property Tax Rates Nancy Jenkins Real Estate

Effective State Income Tax Map Public Assets Institute

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Who Pays 6th Edition Itep

Vermont Who Pays 6th Edition Itep

Vermont Income Tax Vt State Tax Calculator Community Tax

Historical Vermont Tax Policy Information Ballotpedia

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation