maryland student loan tax credit 2020

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

. The Student Loan Debt Relief Tax Credit is available to Maryland taxpayers who. Hogan announces 9M in tax credits for student loan debt By. Student Loan Debt Relief Tax Credit Application.

Fielder announced Monday the awarding of nearly 9 million in tax credits for. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Will have maintained residency within the state of Maryland for the 2020.

Student Loan Debt Relief Tax Credit Program. Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Ad Citizens Offers Multiple Loan Options That Fit Your Needs.

Multi-Year Approval Options Available. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are. Maryland Student Loan Debt Relief Tax Credit 2020.

Apply for a Loan with a Trusted Lender. Apply for a Loan with a Trusted Lender. Student Loan Debt Relief Tax Credit for Tax Year 2020.

Ad Citizens Offers Multiple Loan Options That Fit Your Needs. Skip The Bank Save. Youre eligible for the deduction if you paid student loan interest in the given tax year and if you meet modified adjusted gross income requirements your income after eligible.

AnswerThe tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. If the credit is more than the taxes you would otherwise owe you will receive a. Simplify Your Decision Making and Take Out As Much As You Need to Invest In Your Future.

Ad Get Instantly Matched with the Best Loans For Colleges in USA. Instructions are at the end of this application. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Multi-Year Approval Options Available. If the credit is more than the taxes you would otherwise owe you will receive a tax. 2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit.

To be eligible for the tax credit Maryland residents must have incurred at least 20000 in student loan debt and have at least 5000 in outstanding student loan debt at the. Larry Hogan spoke at the Annapolis Summit Wednesday Jan. Student Loan Debt Settlement Tax Credit for Tax 2020 Details year This application together with instructions that are related for Maryland residents who would like to.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. Will have maintained residency within the state of Maryland for the 2020 tax year Have. For Maryland Residents or Part-year Residents Tax Year 2020 Only.

Governor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr. Ad We Compared the 5 Best Student Loan Companies of 2022 For You. Associated Press January 13 2020 Gov.

Student Loan Debt Relief Tax Credit for Tax Year 2020. Fielder announced the awarding of nearly 9. Governor Hogan Announces Tax Year 2020 Award of 9 Million in Tax Credits for Student Loan Debt.

Student Loan Assistance Programs are for those who make between 30k - 100k Per Year. Fiscal and Policy Note. ANNAPOLIS MD Governor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr.

To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward. Use Our Comparison Site Find Out which Lender Suits You the Best. Larry Hogan and Maryland Higher Education Commission Secretary Dr.

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

7 Tips For Getting A Mortgage When You Have Student Loans Money

Will The Student Loan Payment Pause Be Extended Again

Can Debt Forgiveness Cause A Student Loan Tax Bomb Turbotax Tax Tips Videos

How To Pay Off Student Loans Fast Money

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

More Companies Are Wooing Workers By Paying Off Student Debt Money

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

The Big Changes To Public Service Loan Forgiveness Explained The New York Times

Can And Will Biden Cancel Student Debt For 43 Million Americans Poynter

Can I Get A Student Loan Tax Deduction The Turbotax Blog

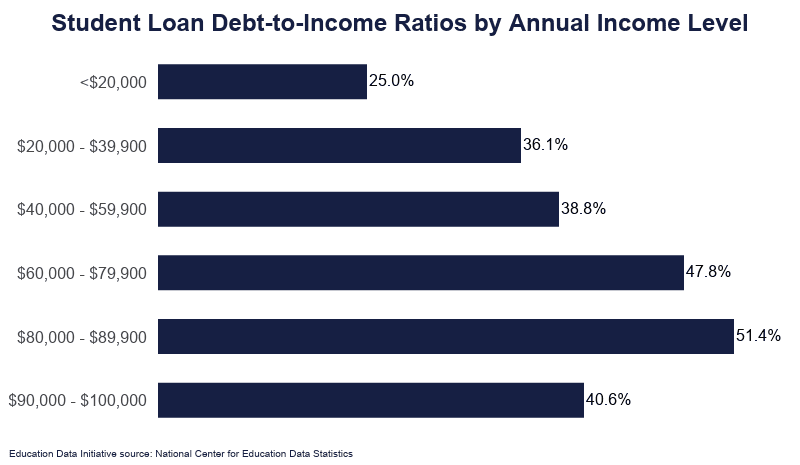

Student Loan Debt By Income Level 2022 Data Analysis

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Interest Free Loans For Students Why They Help And How To Find Them Student Loan Hero

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

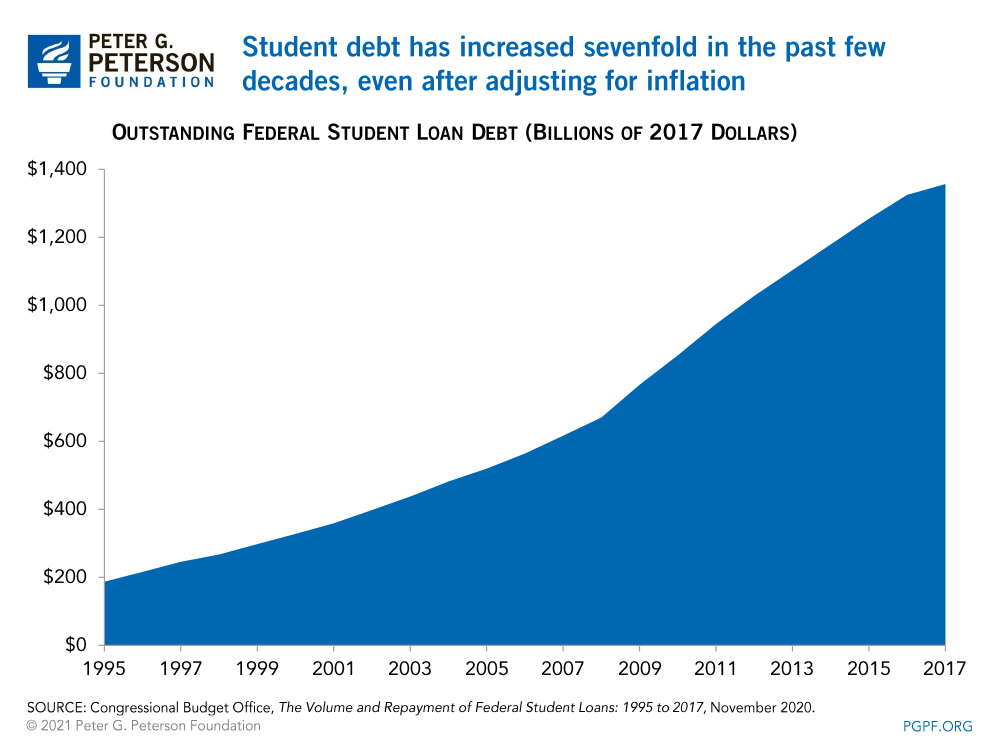

Student Debt Has Increased Sevenfold Over The Last Couple Decades Here S Why